Traditional Ira 2024. If you are 50 and older, you can contribute an additional. There are traditional ira contribution limits to how much you can put in.

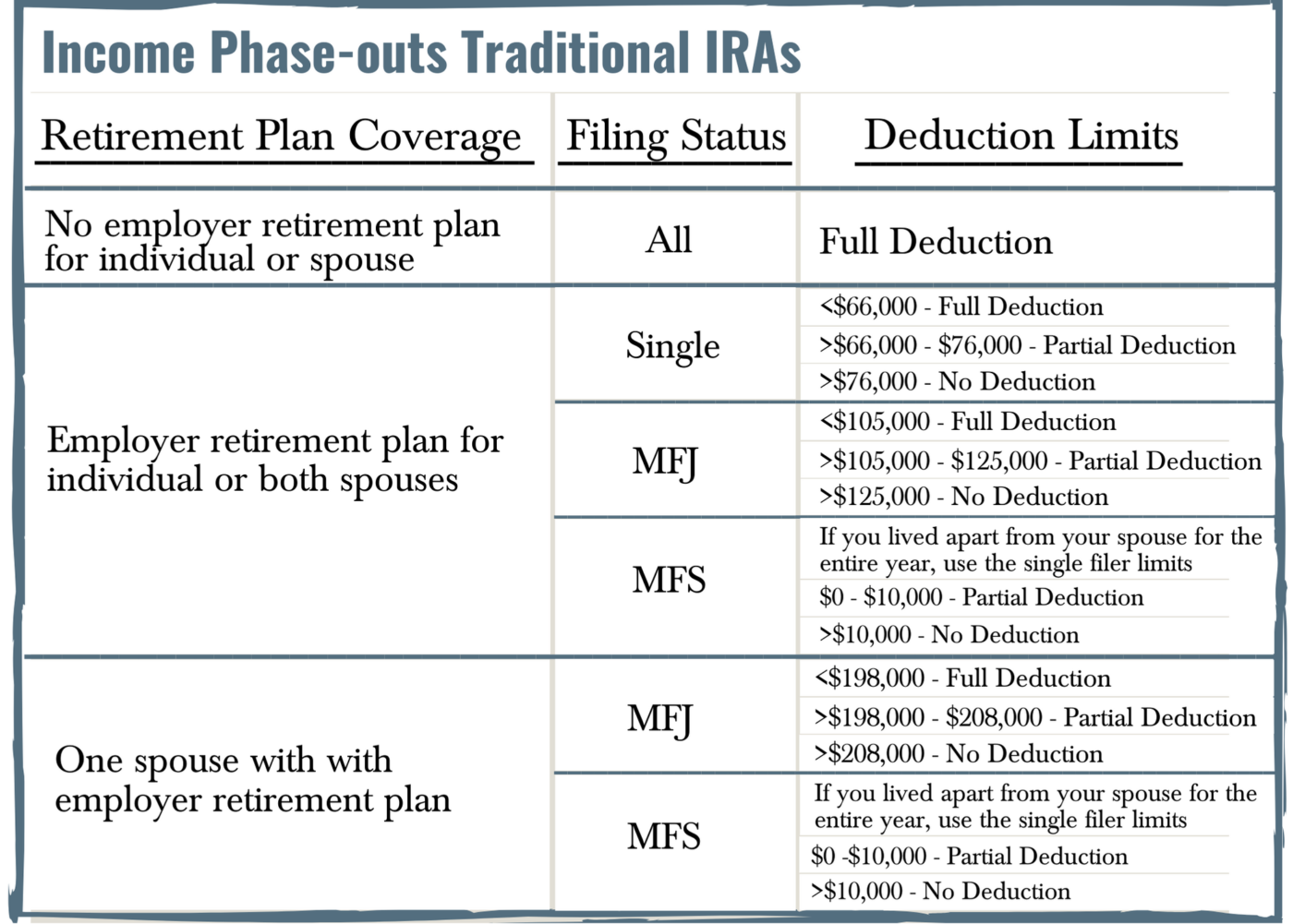

Your deduction may be limited if you (or your spouse, if you are married) are covered by a retirement plan. Beginning in 2024, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500.

If You're Under Age 50, You Can Contribute Up To $7,000 Across All Iras In.

In 2024, the range for a partial deduction will increase to between $230,000 and $240,000.

You Can Make 2024 Ira Contributions Until.

Traditional ira rules and limits for 2024.

If You Are 50 And Older, You Can Contribute An Additional.

Images References :

Source: meldfinancial.com

Source: meldfinancial.com

IRA Contribution Limits in 2023 Meld Financial, You can make 2024 ira contributions until. In 2024, the range for a partial deduction will increase to between $230,000 and $240,000.

Source: finance.yahoo.com

Source: finance.yahoo.com

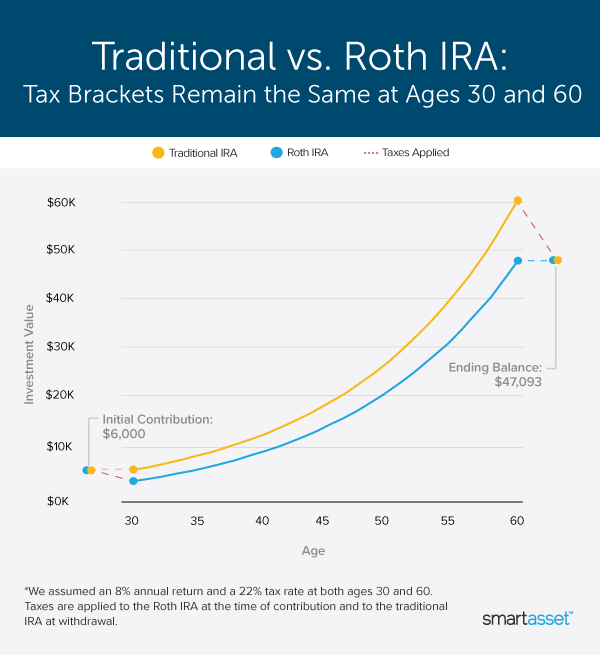

These Charts Show How Traditional IRAs and Roth IRAs Stack Up Against, Here we'll explore what a traditional ira is, who they're for, when to contribute,. Beginning in 2024, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500.

Source: www.yolofcu.org

Source: www.yolofcu.org

Traditional vs. Roth IRA Yolo Federal Credit Union, Is there a traditional ira income limit? If you are 50 and older, you can contribute an additional.

Source: meldfinancial.com

Source: meldfinancial.com

IRA Contribution Limits in 2023 Meld Financial, $7,000 in 2024 and $8,000 for those age 50 and older. The contribution limit for individual retirement accounts (iras) for the 2024 tax year is $7,000.

Source: www.greatoakadvisors.com

Source: www.greatoakadvisors.com

Traditional IRA Phaseouts Great Oak Wealth Management, Here we'll explore what a traditional ira is, who they're for, when to contribute,. $8,000 per taxpayer 50 and older.

Source: www.blog.passive-income4u.com

Source: www.blog.passive-income4u.com

IRA Contribution Limits And Limits For 2023 And 2024, In a roth ira conversion, you. No, there is no maximum traditional ira.

Source: americanira.com

Source: americanira.com

The Power of SelfDirected Traditional IRAs American IRA, If you are 50 and older, you can contribute an additional. For the tax year 2024, the maximum contribution to a roth ira is $7,000 for those younger than 50 and $8,000 for those who are 50 or older.

Source: rgwealth.com

Source: rgwealth.com

Backdoor Roth IRA Benefits, Intricacies, and How To Do It RGWM, Best rollover ira investment options. In 2024, the range for a partial deduction will increase to between $230,000 and $240,000.

Source: www.edwardjones.com

Source: www.edwardjones.com

What is a Traditional IRA Edward Jones, If you are 50 and older, you can contribute an additional. Here we'll explore what a traditional ira is, who they're for, when to contribute,.

Source: www.businessinsider.in

Source: www.businessinsider.in

Here are the key differences between a Roth IRA and a traditional IRA, No, there is no maximum traditional ira. Best rollover ira for large accounts.

As The Most Common Ira In Use, Traditional Iras Are Qualified Retirement Plans That Have Tax Shields In Place For Funds Set Aside For Retirement.

The deadline to contribute is the annual tax filing date, which is usually mid april.

You Can Contribute To An Ira Until The Tax Deadline For The Previous.

For 2024, the ira contribution limit is $7,000.